what is fsa/hra eligible health care expenses

HRA is health reimbursement account or arrangement. SAMPLE CHART OF ELIGIBLE EXPENSES Please note that this is not a complete list but is intended to provide Plan participants with examples to help determine what OTC items may be an eligible expense.

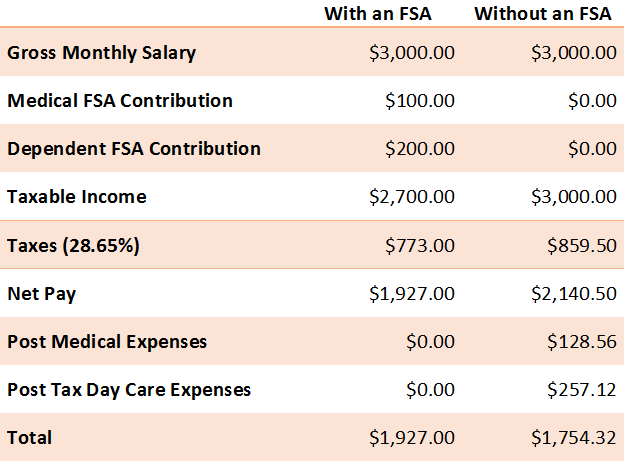

Hsa And Fsa Accounts What You Need To Know Readers Com

Here it is the most-comprehensive eligibility list available on the web.

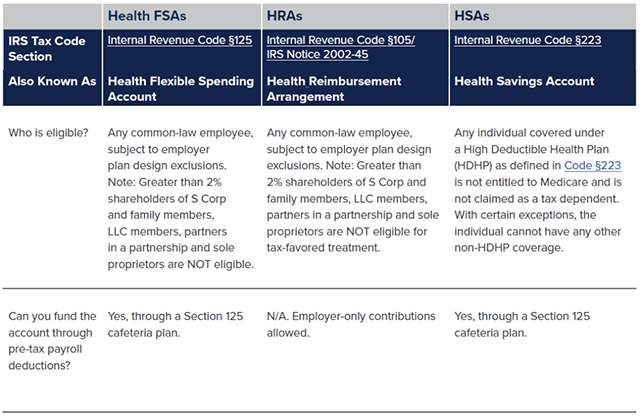

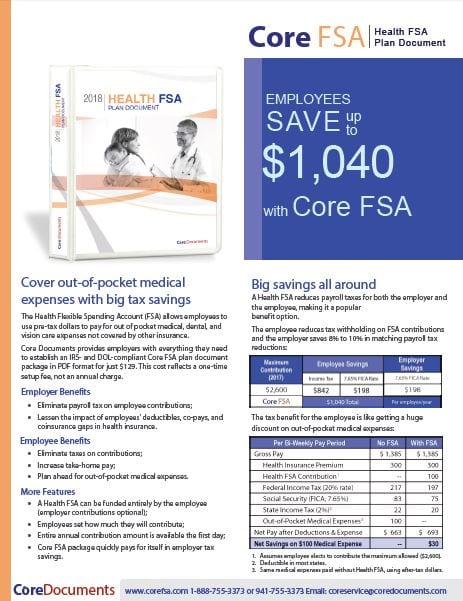

. Benefits of an employer-funded HRA. An HSA may receive contributions from an eligible indi-. HSAs HRAs and FSAs are accounts used to save on taxes and pay for qualified medical prescription dental and vision expenses.

Please see your benefit plan documents to find out which health care expenses are eligible under your HRA. Over-the-counter OTC drugsproducts. HSA and FSA Eligible Expenses for Mom Baby and Parents-to-be Parenting and motherhood are some of the greatest joys in life but it does require some financial planning.

1 800 926-2273. This includes deductibles co-insurance prescriptions dental and vision care and more. Adoption fees associated with and medical expenses for adopted child The expenses associated with the adoption of a child are not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA limited-purpose flexible spending account LPFSA or dependent care flexible spending account.

Registration fees required for eligible care after actual services are received Sick-child care center. Your employer determines which health care expenses are eligible under an HRA. Health Reimbursement Arrangements HRAs Medical Expense Reimbursement Plans MERPs Health Flexible Spending Arrangements FSAs Accident and Health Plans both insured and.

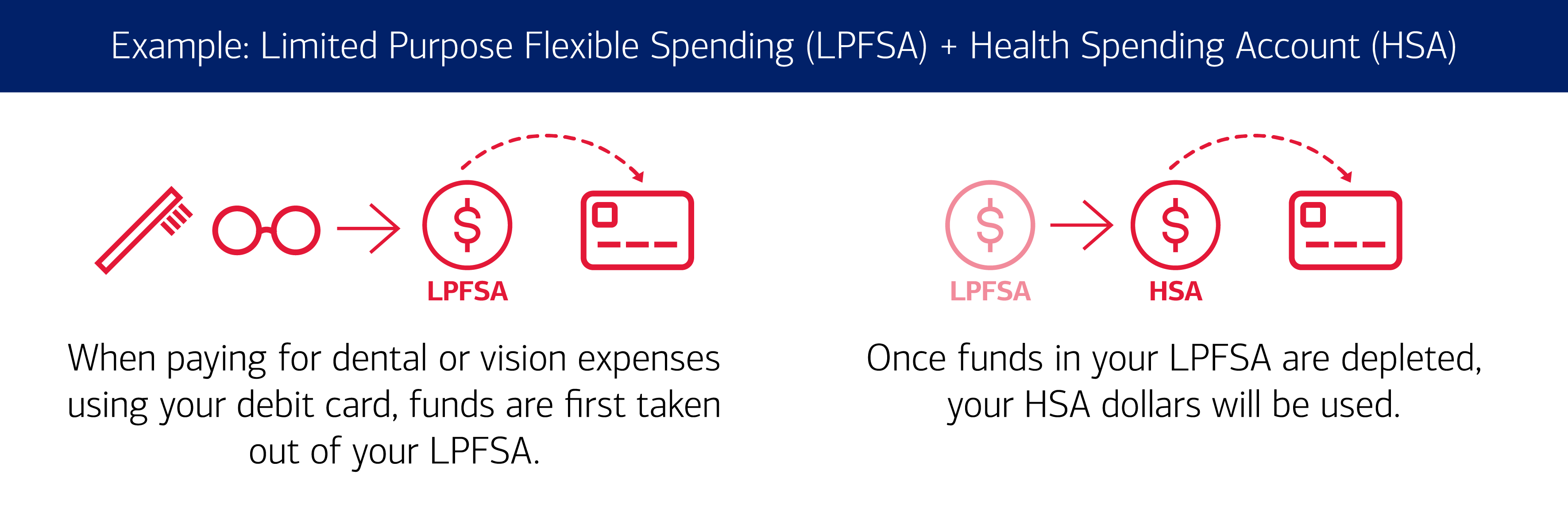

You can pay for a wide range of IRS-qualified medical expenses with your HSA including many that arent typically covered by health insurance plans. To determine if the below listed expenses can be paid by your HRA please refer to your. If you are enrolled in a Limited Medical FSA or Combination Medical FSA your eligible expenses may be different.

The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents who have not yet turned 14 for the 2020 plan yearTo qualify for this relief you must have been enrolled on or before January 31 2020 and you must have unused amounts from the 2020 plan. A health reimbursement arrangement HRA is an account funded by your employer that helps pay for certain out-of-pocket medical expenses. One component of the law was an expansion of products eligible for reimbursement from health savings accounts HSAs and medical flexible spending.

If you have any questions or would like more information about participating in a Cigna health care network please contact us. There are numerous variations of the Section 105 plan including. Eligible Eligible for reimbursement.

Preschoolnursery school for pre-kindergarten. Find a Health Care Form. FSA is flexible spending account or arrangement.

Copays Coinsurance Deductible expenses. If you have a Flexible Spending Account FSA or Health Reimbursement Account HRA you can submit your claim and eligible expenses. Eligible HSA FSA HRA Expenses.

American Benefits Group provides a fully integrated and interactive CDHC platform for all pretax account based plans including Flexible Spending Accounts FSAs and Health Reimbursement Arrangements HRAs Health Savings Accounts HSAs to Commuter Parking and Transit Accounts. Vantages to offset health care costs. It is not eligible for reimbursement from an FSA HRA or HSA.

Health Savings Accounts HSAs. Medical expenses are the costs of diagnosis cure mitigation treatment or prevention of disease and the costs for treatments affecting any part or. 1 800 88CIGNA 882-4462 Behavioral.

In addition if your. Payroll taxes related to eligible care. Medical Savings Accounts Archer MSAs and Medi-care Advantage MSAs.

Thankfully HSAs and FSAs exist to help parents offset the cost of medical expenses for their kids and themselves and there is a long list of items and services that are. For a complete list of IRS-qualified medical expenses visit irsgov or view a list of qualifying examples. To determine if the FSA expenses you wish to submit are eligible check the list below.

Limited Medical FSAHRA Plan participants should check their Plan Highlights to see if OTC items are eligible. Check your plan details for more information. Just open the MyHealth mobile app select Eligible Expense Scanner from the menu then simply scan the item barcode to find out if it can be paid for using your health account.

Find an In-Network Doctor Dentist or Facility. This publication ex-plains the following programs. Health Flexible Spending Arrangements FSAs.

Health Reimbursement Arrangements HRAs. Eligible expense scanner on the MyHealth mobile app Our new barcode scanner takes the guesswork out of what items the IRS considers qualified expenses. In addition we are a leading providerof COBRA and Direct Premium Billing.

Tips for common FSAHRA claims. Keep money in your pocket compliments of your employer. Section 105 of the Internal Revenue Code allows employers to establish a written plan to reimburse medical expenses.

From A to Z items and services deemed eligible for tax-free spending with your Flexible Spending Account FSA Health Savings Account HSA Health Reimbursement Arrangement HRA and more will be here complete with details and requirements. HSA is health savings account. The claim is automatically processed and you are reimbursed directly from your consumer-directed health accounts based on employer plan stacking rules consumer eligibility and available.

The IRS decides which products and services are eligible for purchase or payment using FSA funds. Doc Additional documentation required. Send a pharmacy receipt showing the prescription details and purchase information.

Guidance for eligible expenses is included in IRS Publication 502 Medical and Dental Expenses. CARES Act Expands Eligible Expenses to Include OTC and Feminine Hygiene Products - 3272020 The Coronavirus Aid Relief and Economic Security CARES Act was signed into law on Friday March 27th. HSA Health FSA and HRA Eligible Expenses ConnectYourCare 2021-12-22T101136-0500 There are thousands of eligible expenses for tax-free purchase with a Health Savings Account HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRAincluding prescriptions doctors office copays health insurance.

Learn how a health savings account HSA works to determine which health savings plan may be right for you. Out-of-Pocket Uncovered Medical Care Expenses. This is a letter from your health care provider that includes a recommendation of the item or service to treat your diagnosis and the duration of the recommendation.

Streaming or Auto-Rollover You have two options if your employer has selected integration with your health planClaims are automatically transmitted from your health plan to HSA Bank. Eligible expenses in an HRA will vary depending on plan design.

2022 Fsa Hra And Hsa Comparison Brown Brown

Health Care And Dependent Care Fsas Infographic Optum Financial

Hsa Fsa And Hra Eligible Expenses Cigna Health Savings Account Health Care Expensive

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Using Your Health And Benefit Visa Debit Card

Hsa Vs Fsa Which Is Better Comparison Chart Included Health Savings Account Flex Spending Account Health Insurance Humor

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

5 New Expenses Eligible For Your Hsa Fsa Funds Advantage Administrators

Comparing Hsas Hras And Fsas Which Approach Is Best Exude

What Do I Need To Know About Fsas And Hsas One Medical

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Hra Vs Fsa See The Benefits Of Each Wex Inc

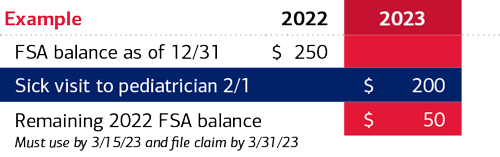

Understanding The Year End Spending Rules For Your Health Account

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive

Fsa Eligible Expenses One Sheet Optum Financial

Fsa Eligible Items Top Tips And What You Can Purchase At A Glance

Fsa Hsa Hra Comparison And Differences Homecare Hospital Beds

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference